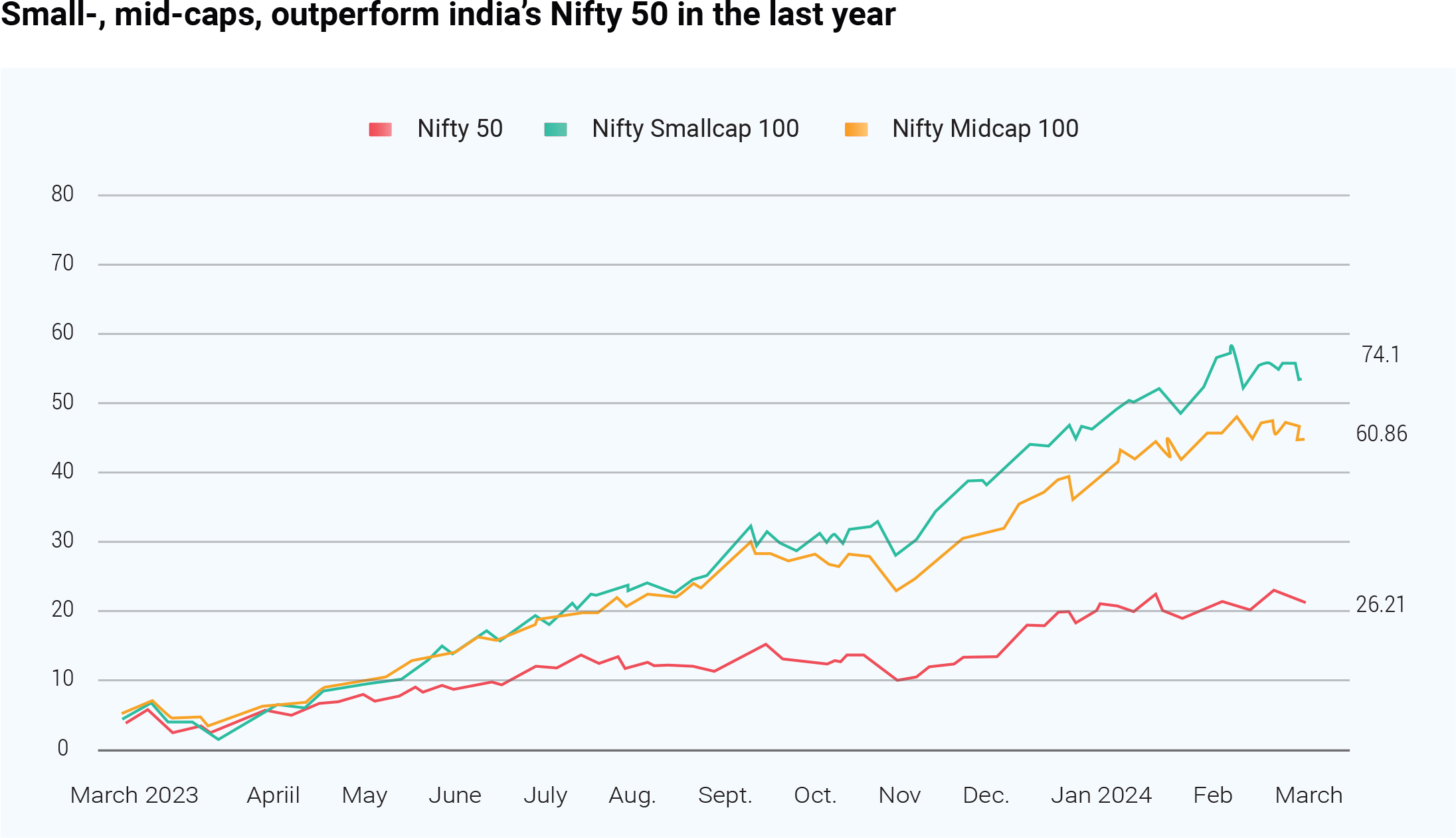

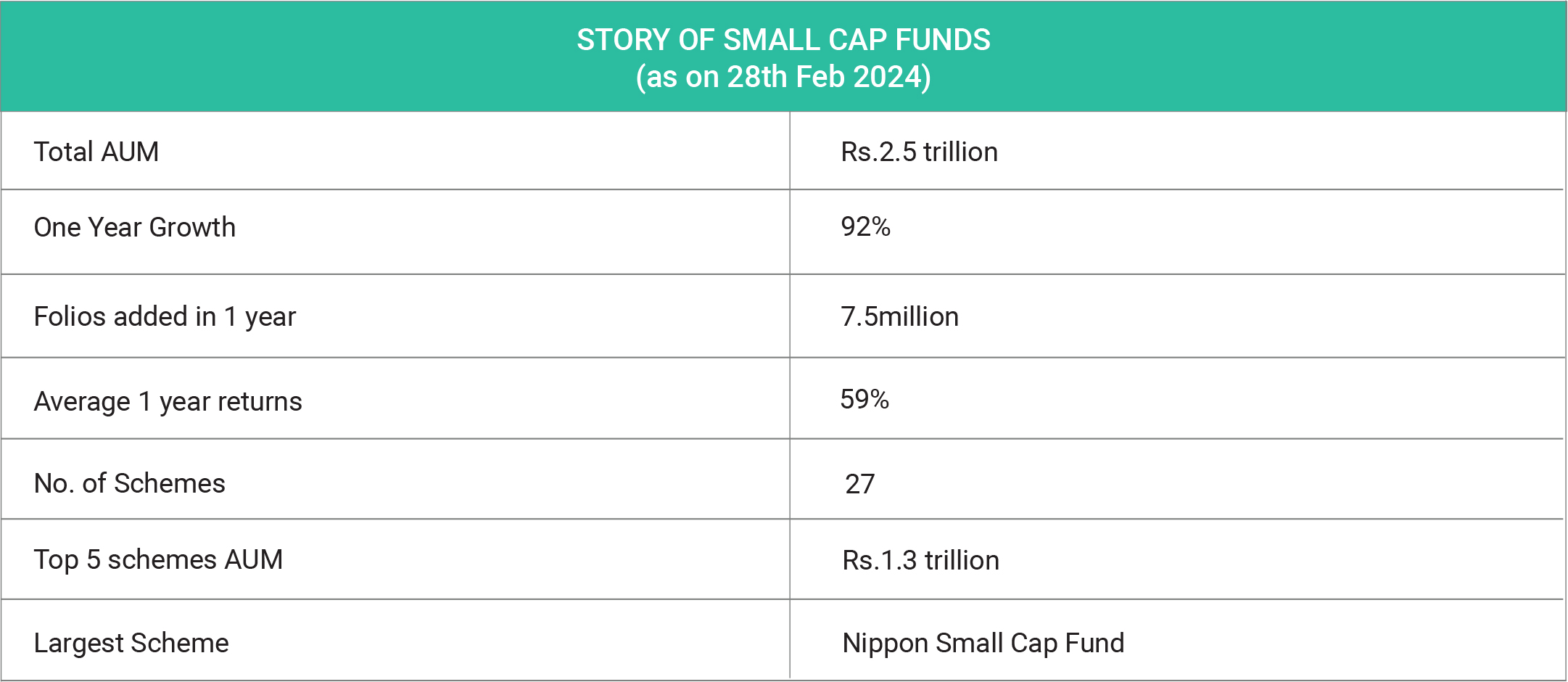

On 29th February 2024, the Securities & Exchange Board of India (SEBI), the country's market regulator, has directed money managers to implement crucial measures addressing concerns surrounding small and mid cap stock mutual funds. The move aims to manage the burgeoning froth in the broader markets and protect the interests of investors. SEBI's directive encourages money managers to consider limiting one-off investments from clients in small and mid cap funds while also reducing the commissions associated with their sale. The Association of Mutual Funds in India (AMFI) has echoed these sentiments, urging asset management companies (AMCs) to formulate policies safeguarding investors in the smallcap and midcap segments. In recent times, the Indian mutual fund industry has witnessed remarkable growth, particularly in small and mid-cap funds. The Nifty Small-Cap 100 index surged by an impressive 74% over the past 52 weeks, and the Nifty Mid-Cap 100 index also saw a substantial rise of 60.86%. These gains have significantly outpaced the benchmark Nifty's 26.21% increase over the same period, prompting regulatory bodies to take notice and address potential risks. Rapid Asset Growth: The assets managed by small-cap funds in India soared by a staggering 86.5% over a 10-month period, reaching 2.48 trillion rupees ($29.92 billion) by the end of January. Simultaneously, mid-cap funds experienced a substantial jump of 58.5%,. approaching the 2.99 trillion rupees managed by large-cap funds. This rapid asset growth has raised concerns about market froth and prompted regulatory intervention.

SEBI's Concerns and Measures: The Securities and Exchange Board of India (SEBI), the country's market regulator, expressed concerns about a potential froth in the market, especially in small-cap funds. Inflows into these funds increased by an alarming 92% in the first 10 months of the fiscal year, leading to SEBI's heightened scrutiny. To address these concerns, SEBI issued a letter to money managers, urging them to consider restricting one-off investments in small and mid-cap stock mutual funds. Additionally, SEBI recommended a reduction in commissions for the sale of these funds

Enhancing Transparency and Investor Protection: To

further safeguard investor interests, SEBI has mandated

additional risk disclosures for small and mid-cap funds.

This move aims to provide investors with a clearer

understanding of the potential risks associated with

these funds, promoting transparency and informed

decision-making.

AMFI's Initiatives: The Association of Mutual Funds in

India (AMFI), an industry body, has played a proactive

role in ensuring investor protection and market stability.

In a letter to fund houses, AMFI urged them to put in

place policies that protect investors, including

moderating inflows. Additionally, AMFI requested funds

to disclose the results of internal stress tests and details

on the time needed to liquidate portions of the portfolio

(25% or 50%). These disclosures are expected to be

made by the 15th of each month, providing investors with

crucial insights into the liquidity and risk management

strategies of the funds.

To address specific concerns, regulators are honing in on

critical areas:

Commissions: Some asset managers are proactively

reducing distributor commissions on small- and mid-cap

funds, contemplating additional costs for exiting

investors during substantial outflows. Regulators

propose temporary exit loads or swing pricing to manage

the impact of large fund outflows.

New small-cap stocks: Despite the surge in inflows and

returns, there's a cautious approach to adding new

small-cap stocks to portfolios. Regulators emphasize

the need for a vigilant assessment of segment growth

and diversification strategies.

Concentrated investment strategies: Regulators are

advising trustees to adopt proactive measures, such as

moderating inflows and rebalancing portfolios, to shield

investors from the potential negative impacts associated

with redeeming investors.

Small-cap funds have faced a balancing act recently.

Concerns about high valuations led some funds to limit

new investments. For instance, SBI Small Cap Fund

stopped accepting lump sums in 2020, followed by Tata

Small Cap Fund last year. Just recently, Kotak Small Cap

Fund announced restrictions, allowing only ₹25,000

monthly via SIP and a maximum ₹2 lakh lump sum

investment.

This success of small-cap funds, despite regulations and

market volatility, presents both opportunities and

challenges for investors. On the positive side, it

showcases the potential for exceptional returns in the

small-cap space, thanks to skilled fund management and

strategic stock picking. However, as the mutual fund

industry adapts under SEBI's regulations, investors are

reminded of the crucial role of informed decisions.

Aligning investments with your risk tolerance and

financial goals remains paramount.