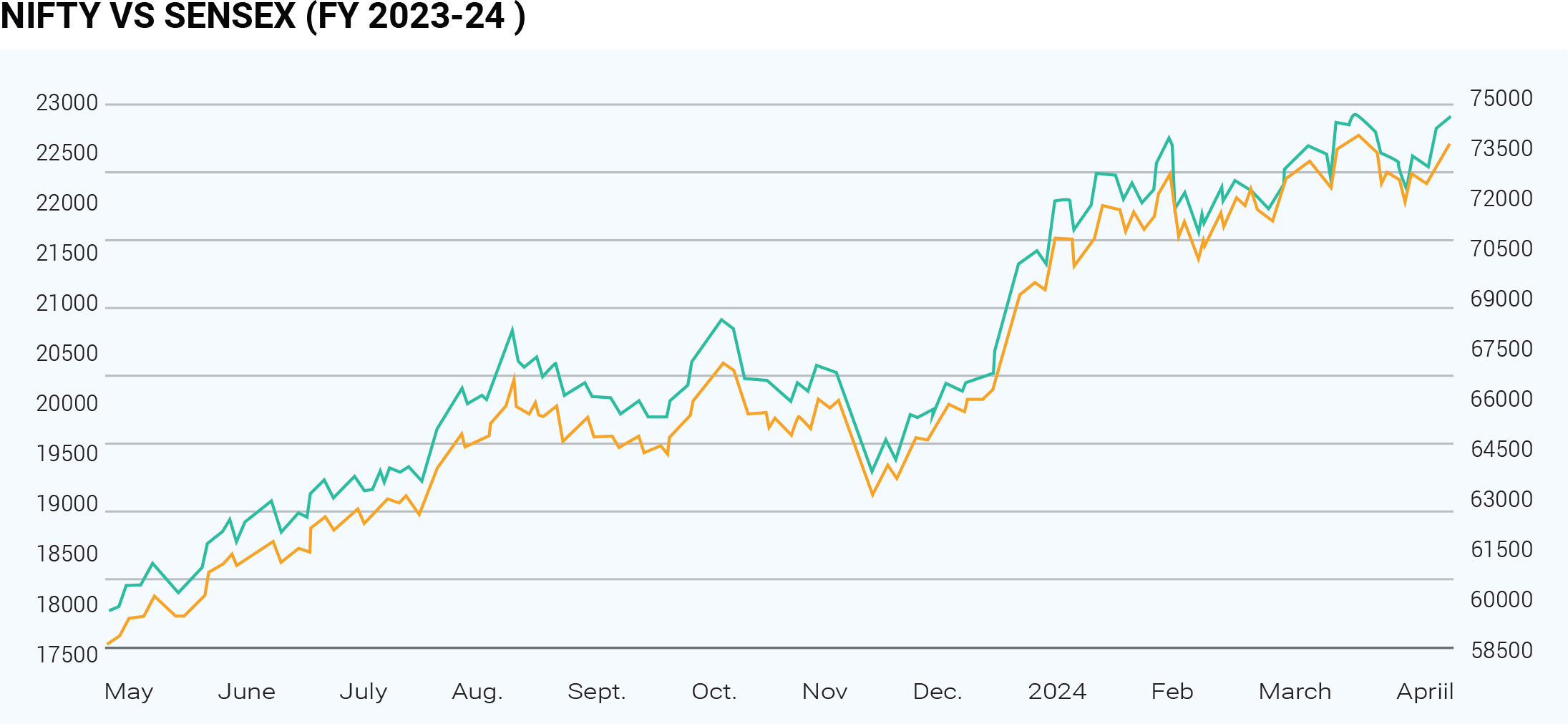

The Indian stock market closed FY2023-24 on a

triumphant note, with the Sensex index surging over 655

points (1%) to reach a record-breaking closing level of

73,651.35. This impressive ending capped off a year

defined by consistent growth and a series of record highs

for both the Sensex and Nifty. FY2023-24 was a true

blockbuster year for the Indian market. Both benchmark

indices repeatedly shattered previous records,

highlighting robust market confidence. A significant

milestone was achieved in November 2023 when the

market capitalization of BSE-listed companies crossed a

staggering ₹333 lakh crore (approximately $4 trillion).

This growth builds upon the impressive gains witnessed

in FY2021, with the market continuing its upward

trajectory in FY2024 and registering an overall gain of

around 25%.

Several factors fuelled this stellar performance. Strong

economic fundamentals, characterized by healthy

economic growth and positive corporate earnings,

instilled confidence in investors throughout the year. This

positive sentiment was further bolstered by the fact that

9 out of 12 months ended in positive territory, signifying

a consistently bullish market. Beyond these core drivers,

FY2024 witnessed a surge in initial public offerings

(IPOs) and mega-mergers, reflecting increased investor

interest and market activity. The year was also marked by

swift and decisive regulatory responses from authorities,

which further strengthened investor trust in the market

system. This combination of robust economic

conditions, positive corporate performance, increased

investor activity, and a strong regulatory environment all

contributed to the Indian stock market's phenomenal

performance in FY2023-24. This year serves as a

testament to the resilience and potential of the Indian

market, paving the way for continued growth in the years

to come.

NIFTY breached all levels and continues to stride

touching new lifetime high of 22,525 on 7th March 2024.

The Nifty 50 index, reflecting the performance of top-tier

companies, has surged by 30% so far in FY24. Large-cap

companies have also demonstrated robust performance

in FY24, with several stocks delivering multibagger

returns. Large cap gave a return of 33%, mid cap

increased by 56% and small cap left everyone behind and

gave a spectacular return of 63% in FY24.The sectors

which have witnessed extraordinary gains are Realty,

Central Public Sector Enterprise (CPSE) and

infrastructure. The BSE Realty index, for instance,

experienced an astonishing surge of 130%, accompanied

by significant gains in Power (83%), Capital Goods (75%),

and Auto (72%). The realty sector performed

exceptionally well, followed by Cabonex at 114% and

CPSE at 100%. Public Sector Undertaking (PSU) stocks

have emerged as standout performers in FY24, offering

substantial returns to investors, with some stocks

witnessing up to five-fold increases in their value. In

FY24,IPO market flourished witnessing a surge in activity

with approximately 75 new issues launched. Many

companies delivered over 150% post listing. The average

listing gain saw a notable increase to 29%, highlighting

the investor enthusiasm for these new offerings.

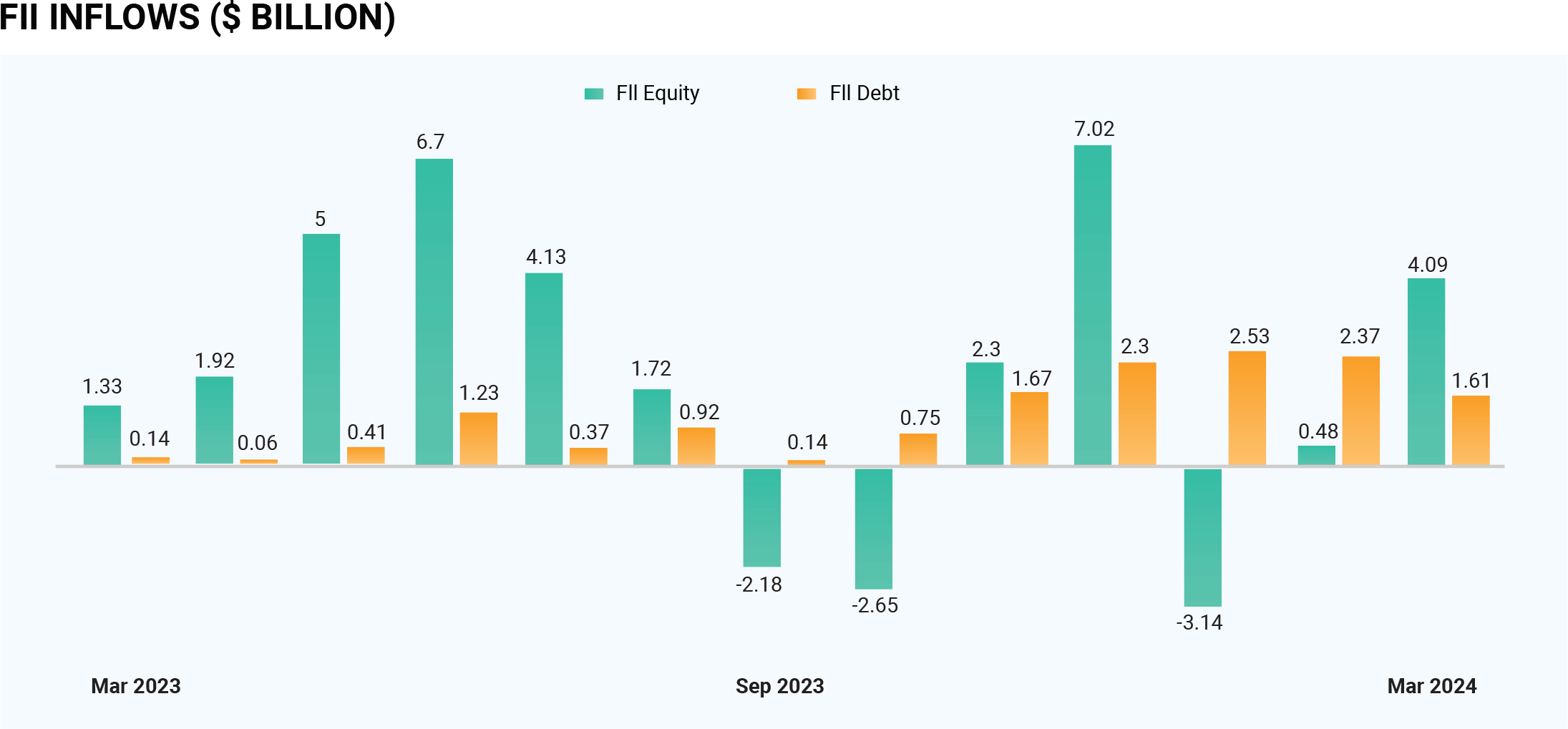

Foreign Portfolio Investors (FPIs) have displayed renewed confidence in Indian equities, injecting more than Rs 2 lakh crore into the market in 2023-24, driven by optimism surrounding the country’s robust economic fundamentals amidst a challenging global environment. Foreign Portfolio Investors (FPIs) have made a net investment of around Rs 2.08 lakh crore in the Indian equity markets and Rs 1.2 lakh crore in the debt market. Collectively, they pumped Rs 3.4 lakh crore into the capital market, as per data available with the depositories. FPI debt flows have gathered momentum since November 2023 because of sentiment buying post announcement of India’s inclusion to JP Morgan Global Bond Index. Also, India’s buoyant growth story coupled with fiscal prudence, leveraged sentiments of foreign investors at a time when still some degree of uncertainty prevailed over the outlook of the global economy. India's 10-year yield is expected to continue its downward trend, potentially breaching 6.95% in the second half (H2) due to a confluence of factors. Favourable growth-inflation dynamics coupled with potential RBI rate cuts (25-50 bps from August) are expected to drive the decline. Expecting the foreign portfolio inflows (FPI) would provide support the markets.

Throughout 2023-2024, Gold prices in India remained

elevated due to rising geopolitical tensions around the

globe. The value of this precious metal also fluctuated

significantly, impacted by slowing economic growth in

developed countries and efforts by central banks

worldwide to curb inflation through stricter monetary

policies. Historically gold has earned a reputation as a

safe haven. When economic storms brew or geopolitical

tensions rise, investors often seek refuge in this precious

metal. Gold's appeal stems from its ability to hold its

value over time, acting as a shield against inflation and

the erosion of currencies. MCX gold price rallied more

than 12% in FY24, from around ₹59,400 per 10 grams at

the beginning of the year to around ₹67,000 per 10 grams

at the end. According to the World Gold Council (WGC),

gold demand in India is expected to rise to 800-900

tonnes in the calendar year 2024 on the back of robust

economic growth and higher income. This would usher

the gold prices in FY 2024-2025.

In FY24, the rupee plummeted by 1.5% against the US

dollar, compared to the previous fiscal year's 8% decline.

Despite surging oil prices and a strengthening dollar, the

rupee fared better compared to other emerging market

currencies. On the last day of FY24, the rupee closed at

83.40. While crude prices rallied as much as 19% from

their December lows, the dollar index gained 3.5% to 105

during the same period. India has been vulnerable to high

global oil prices as the country imports 87% of its oil

demand. High oil prices would widen India's current

account deficit (CAD) and put pressure on the currency.

Foreign flows of $40 billion to equity and debt markets

also backed the currency. Adding to this, Bloomberg

announced in March 2024 its decision to include India's

Fully Accessible Route (FAR) bonds in the Bloomberg

Emerging Market (EM) Local Currency Government Index

and related indices, phased in over 10 months, starting at

the end of January 2025. This would attract inflows of

around $25-30 billion over the next year.

The evolving global and domestic interest rate dynamics

could expose Indian markets to vulnerabilities. For India,

ensuring sustained economic growth and robust

corporate earnings will be crucial for maximizing returns.

Furthermore, ongoing geopolitical tensions worldwide

and China's economic resurgence will greatly impact the

future of Indian markets. Expect significant

transformations in the global economic and financial

landscape in the coming days.