The Indian stock market closed FY2023-24 on a

triumphant note, with the Sensex index surging over 655

points (1%) to reach a record-breaking closing level of

73,651.35. This impressive ending capped off a year

defined by consistent growth and a series of record highs

for both the Sensex and Nifty. FY2023-24 was a true

blockbuster year for the Indian market. Both benchmark

indices repeatedly shattered previous records,

highlighting robust market confidence. A significant

milestone was achieved in November 2023 when the

market capitalization of BSE-listed companies crossed a

staggering ₹333 lakh crore (approximately $4 trillion).

This growth builds upon the impressive gains witnessed

in FY2021, with the market continuing its upward

trajectory in FY2024 and registering an overall gain of

around 25%.

Several factors fuelled this stellar performance. Strong

economic fundamentals, characterized by healthy

economic growth and positive corporate earnings,

instilled confidence in investors throughout the year. This

positive sentiment was further bolstered by the fact that

9 out of 12 months ended in positive territory, signifying

a consistently bullish market. Beyond these core drivers,

FY2024 witnessed a surge in initial public offerings

(IPOs) and mega-mergers, reflecting increased investor

interest and market activity. The year was also marked by

swift and decisive regulatory responses from authorities,

which further strengthened investor trust in the market

system. This combination of robust economic

conditions, positive corporate performance, increased

investor activity, and a strong regulatory environment all

contributed to the Indian stock market's phenomenal

performance in FY2023-24. This year serves as a

testament to the resilience and potential of the Indian

market, paving the way for continued growth in the years

to come.

NIFTY breached all levels and continues to stride

touching new lifetime high of 22,525 on 7th March 2024.

The Nifty 50 index, reflecting the performance of top-tier

companies, has surged by 30% so far in FY24. Large-cap

companies have also demonstrated robust performance

in FY24, with several stocks delivering multibagger

returns. Large cap gave a return of 33%, mid cap

increased by 56% and small cap left everyone behind and

gave a spectacular return of 63% in FY24.The sectors

which have witnessed extraordinary gains are Realty,

Central Public Sector Enterprise (CPSE) and

infrastructure. The BSE Realty index, for instance,

experienced an astonishing surge of 130%, accompanied

by significant gains in Power (83%), Capital Goods (75%),

and Auto (72%). The realty sector performed

exceptionally well, followed by Cabonex at 114% and

CPSE at 100%. Public Sector Undertaking (PSU) stocks

have emerged as standout performers in FY24, offering

substantial returns to investors, with some stocks

witnessing up to five-fold increases in their value. In

FY24,IPO market flourished witnessing a surge in activity

with approximately 75 new issues launched. Many

companies delivered over 150% post listing. The average

listing gain saw a notable increase to 29%, highlighting

the investor enthusiasm for these new offerings.

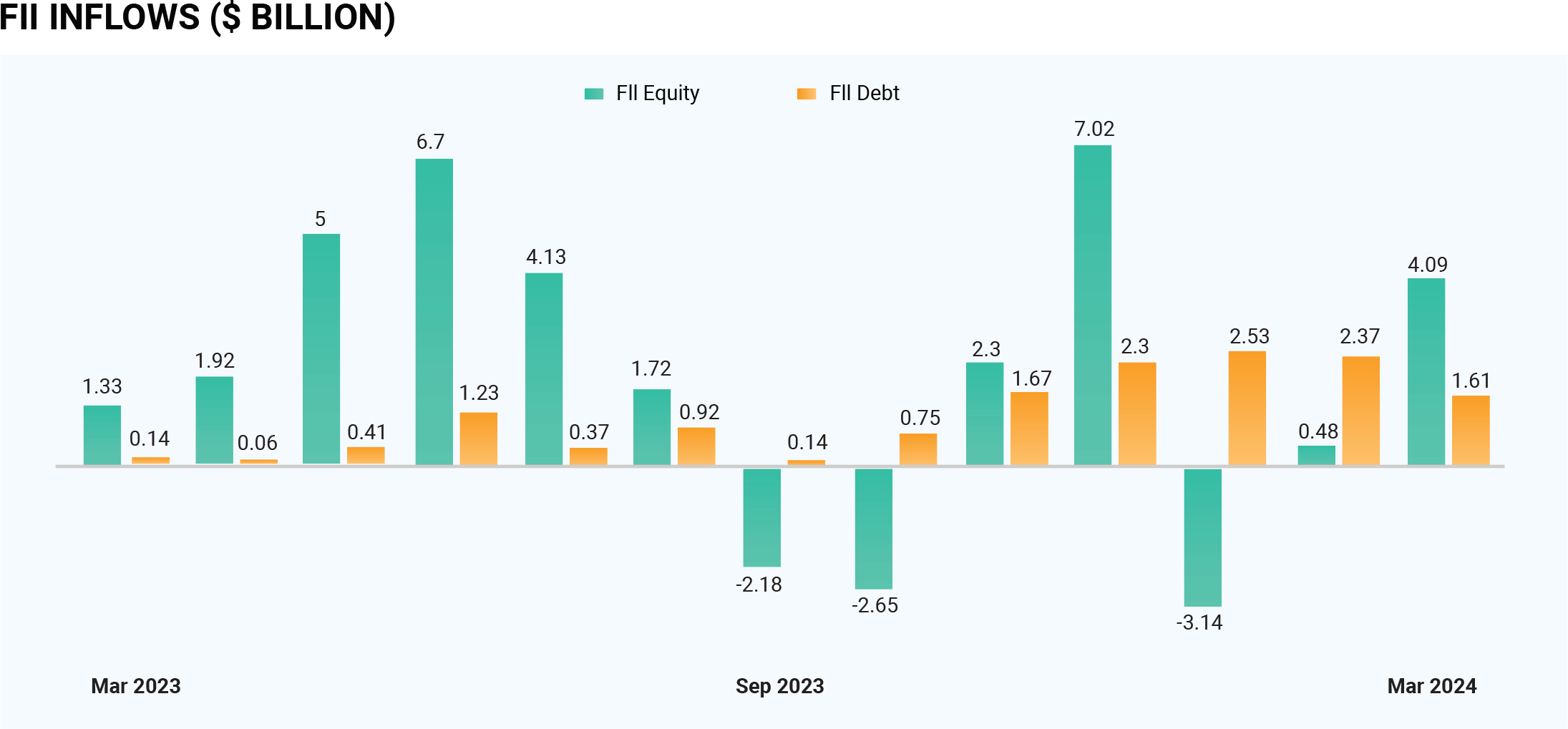

Foreign Portfolio Investors (FPIs) have displayed renewed confidence in Indian equities, injecting more than Rs 2 lakh crore into the market in 2023-24, driven by optimism surrounding the country’s robust economic fundamentals amidst a challenging global environment. Foreign Portfolio Investors (FPIs) have made a net investment of around Rs 2.08 lakh crore in the Indian equity markets and Rs 1.2 lakh crore in the debt market. Collectively, they pumped Rs 3.4 lakh crore into the capital market, as per data available with the depositories. FPI debt flows have gathered momentum since November 2023 because of sentiment buying post announcement of India’s inclusion to JP Morgan Global Bond Index. Also, India’s buoyant growth story coupled with fiscal prudence, leveraged sentiments of foreign investors at a time when still some degree of uncertainty prevailed over the outlook of the global economy. India's 10-year yield is expected to continue its downward trend, potentially breaching 6.95% in the second half (H2) due to a confluence of factors. Favourable growth-inflation dynamics coupled with potential RBI rate cuts (25-50 bps from August) are expected to drive the decline. Expecting the foreign portfolio inflows (FPI) would provide support the markets.

Throughout 2023-2024, Gold prices in India remained

elevated due to rising geopolitical tensions around the

globe. The value of this precious metal also fluctuated

significantly, impacted by slowing economic growth in

developed countries and efforts by central banks

worldwide to curb inflation through stricter monetary

policies. Historically gold has earned a reputation as a

safe haven. When economic storms brew or geopolitical

tensions rise, investors often seek refuge in this precious

metal. Gold's appeal stems from its ability to hold its

value over time, acting as a shield against inflation and

the erosion of currencies. MCX gold price rallied more

than 12% in FY24, from around ₹59,400 per 10 grams at

the beginning of the year to around ₹67,000 per 10 grams

at the end. According to the World Gold Council (WGC),

gold demand in India is expected to rise to 800-900

tonnes in the calendar year 2024 on the back of robust

economic growth and higher income. This would usher

the gold prices in FY 2024-2025.

In FY24, the rupee plummeted by 1.5% against the US

dollar, compared to the previous fiscal year's 8% decline.

Despite surging oil prices and a strengthening dollar, the

rupee fared better compared to other emerging market

currencies. On the last day of FY24, the rupee closed at

83.40. While crude prices rallied as much as 19% from

their December lows, the dollar index gained 3.5% to 105

during the same period. India has been vulnerable to high

global oil prices as the country imports 87% of its oil

demand. High oil prices would widen India's current

account deficit (CAD) and put pressure on the currency.

Foreign flows of $40 billion to equity and debt markets

also backed the currency. Adding to this, Bloomberg

announced in March 2024 its decision to include India's

Fully Accessible Route (FAR) bonds in the Bloomberg

Emerging Market (EM) Local Currency Government Index

and related indices, phased in over 10 months, starting at

the end of January 2025. This would attract inflows of

around $25-30 billion over the next year.

The evolving global and domestic interest rate dynamics

could expose Indian markets to vulnerabilities. For India,

ensuring sustained economic growth and robust

corporate earnings will be crucial for maximizing returns.

Furthermore, ongoing geopolitical tensions worldwide

and China's economic resurgence will greatly impact the

future of Indian markets. Expect significant

transformations in the global economic and financial

landscape in the coming days.

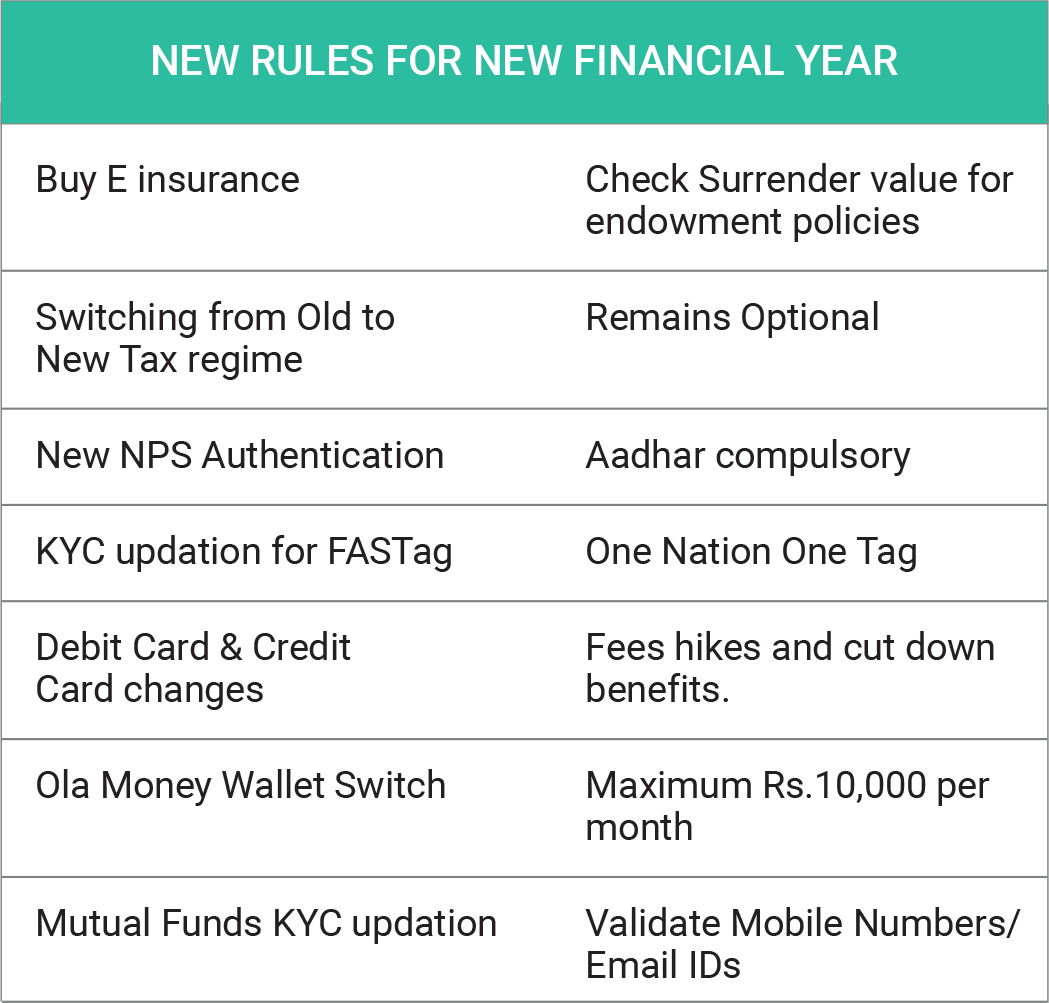

The new financial year (2024-25) ushers in significant

changes affecting your personal finances. From taxes

and credit cards to insurance, and even FASTags, get

ready for adjustments starting April 1st, 2024. This

marks the implementation of the Union Budget

proposals, impacting various aspects of the financial

system. These few changes would provide more security

to the investors and easy accessibility. Understanding

these updates is crucial, as some will become essential

for managing your personal finances effectively.

E-Insurance & Surrender Charges

In a notification "Protection of Policyholders’ Interests,

Operations and Allied Matters of Insurers Regulations,

2024" dated March 20, 2024, the Insurance Regulatory

and Development Authority of India (IRDAI) said, "Every

insurer shall have in place a Board approved policy for

insurance policies issued in electronic form…” Under this

directive all the insurance policies like health, life and

general insurance will be issued electronically.

Surrender value in insurance is the sum disbursed by the

insurer to the policy holder when policy is terminated

prematurely. The Insurance Regulatory and Development

Authority of India (IRDAI) has announced the final set of

rules on surrender value. From April 1, 2024, the

surrender value is expected to remain the same or even

lower if policies are surrendered up to a period of within

three years. However, if policies are surrendered between

the fourth and seventh years, there can be a marginal

increase in surrender value.

New or Old Tax Regime

The New Tax Regime will be the default tax regime from

April 1. This implies that unless individuals explicitly

choose to abide by the old tax structure, taxes will be

automatically assessed and applied according to this

new system. The income tax slabs in the new tax regime

will remain unchanged for FY 2024-25 (AY 2025-26). No

changes have been announced in the interim budget.

With respect to these regulations under the renewed

scheme of things, any individual earning an income up to

Rs 7 lakh annually shall not bear liability for paying taxes.

The changes aim to simplify the process of tax planning

while providing relief to the taxpayers. The Centre will

implement the New Tax Regime as the default setting,

which implies that unless individuals manually choose to

abide by the old tax structure, taxes will be automatically

assessed and applied according to this new system.

New NPS Authentication

The process to log in at the website of the National

Pension System (NPS) and check accounts changed on

April 1. The Central Record Keeping Agency (CRA)

system of NPS has implemented an Aadhaar-based login

authentication mechanism that will be in addition to the

website requiring user ID and personal password. Login

would involve a two-factor Aadhaar-based

authentication, as per changes sought by the Pension

Fund Regulatory and Development Authority (PFRDA).

New Rule for FASTag

From 1st April, vehicle owner needs to update the KYC of

car’s FASTag with the bank. Now its mandatory to

complete KYC process for FASTag before March 31st to

avoid deactivation by banks. With KYC updation payment

are not possible and driver can land up paying double toll

tax charges. NHAI advises the FASTag users to comply

to the RBI rules for smooth transaction at toll plazas.

Credit/Debit Cards Costlier

As SBI announces removes reward points on rent

payment transactions from 1st April 2024, many other

banks also announced these changes in their credit card

perks. The next is credit card which also announced

changes for the easy access to the airport lounge

facilities and there are increase in the charges too.

Individuals need to check from their respective banks.

OLA Money wallet Switch

OLA Money announced that it is entirely switching to small

PPI (prepaid payment instrument) wallet services, with a

maximum wallet load restriction of Rs 10,000 per month

starting April 1, 2024. The company sent SMSs to its

customers informing them about this on March 22, 2024.

Mutual funds need KYC

From April 1, investors who have not re-done their KYC

(know your customer) will be not allowed to do any MF

transactions. These would include SIPs (systematic

investment plan), SWPs (systematic withdrawal plan)

and redemptions. Emails were sent by registrar and

transfer agents (RTAs), CAMS (Computer Age

Management Services) and KFin Technologies

(KFintech) to mutual fund distributors (MFD) that MF

investors should re-do their KYC (know your customer)

by March 31. The officially valid documents as

mentioned in these emails include Aadhaar card,

passport, voter ID card, among others. KYC done based

on proofs such as bank statements and utility bills will no

longer hold valid after this deadline.

By implementing these changes, we can achieve better

governance of the country's financial and economic

landscape. Investor awareness of these changes will

empower them to make informed decisions about their

financial limitations and opportunities for future

spending and investments.

Copyright © 2021 Fintso