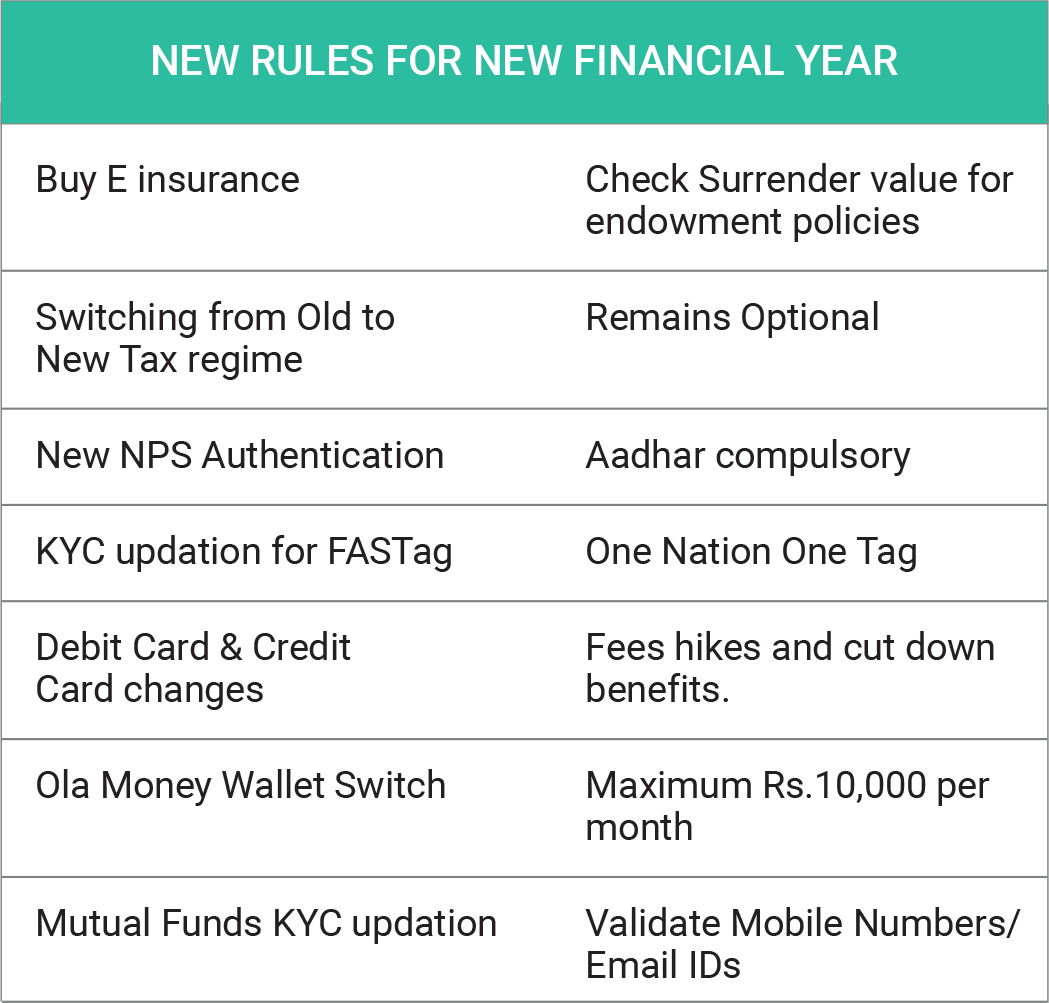

The new financial year (2024-25) ushers in significant

changes affecting your personal finances. From taxes

and credit cards to insurance, and even FASTags, get

ready for adjustments starting April 1st, 2024. This

marks the implementation of the Union Budget

proposals, impacting various aspects of the financial

system. These few changes would provide more security

to the investors and easy accessibility. Understanding

these updates is crucial, as some will become essential

for managing your personal finances effectively.

E-Insurance & Surrender Charges

In a notification "Protection of Policyholders’ Interests,

Operations and Allied Matters of Insurers Regulations,

2024" dated March 20, 2024, the Insurance Regulatory

and Development Authority of India (IRDAI) said, "Every

insurer shall have in place a Board approved policy for

insurance policies issued in electronic form…” Under this

directive all the insurance policies like health, life and

general insurance will be issued electronically.

Surrender value in insurance is the sum disbursed by the

insurer to the policy holder when policy is terminated

prematurely. The Insurance Regulatory and Development

Authority of India (IRDAI) has announced the final set of

rules on surrender value. From April 1, 2024, the

surrender value is expected to remain the same or even

lower if policies are surrendered up to a period of within

three years. However, if policies are surrendered between

the fourth and seventh years, there can be a marginal

increase in surrender value.

New or Old Tax Regime

The New Tax Regime will be the default tax regime from

April 1. This implies that unless individuals explicitly

choose to abide by the old tax structure, taxes will be

automatically assessed and applied according to this

new system. The income tax slabs in the new tax regime

will remain unchanged for FY 2024-25 (AY 2025-26). No

changes have been announced in the interim budget.

With respect to these regulations under the renewed

scheme of things, any individual earning an income up to

Rs 7 lakh annually shall not bear liability for paying taxes.

The changes aim to simplify the process of tax planning

while providing relief to the taxpayers. The Centre will

implement the New Tax Regime as the default setting,

which implies that unless individuals manually choose to

abide by the old tax structure, taxes will be automatically

assessed and applied according to this new system.

New NPS Authentication

The process to log in at the website of the National

Pension System (NPS) and check accounts changed on

April 1. The Central Record Keeping Agency (CRA)

system of NPS has implemented an Aadhaar-based login

authentication mechanism that will be in addition to the

website requiring user ID and personal password. Login

would involve a two-factor Aadhaar-based

authentication, as per changes sought by the Pension

Fund Regulatory and Development Authority (PFRDA).

New Rule for FASTag

From 1st April, vehicle owner needs to update the KYC of

car’s FASTag with the bank. Now its mandatory to

complete KYC process for FASTag before March 31st to

avoid deactivation by banks. With KYC updation payment

are not possible and driver can land up paying double toll

tax charges. NHAI advises the FASTag users to comply

to the RBI rules for smooth transaction at toll plazas.

Credit/Debit Cards Costlier

As SBI announces removes reward points on rent

payment transactions from 1st April 2024, many other

banks also announced these changes in their credit card

perks. The next is credit card which also announced

changes for the easy access to the airport lounge

facilities and there are increase in the charges too.

Individuals need to check from their respective banks.

OLA Money wallet Switch

OLA Money announced that it is entirely switching to small

PPI (prepaid payment instrument) wallet services, with a

maximum wallet load restriction of Rs 10,000 per month

starting April 1, 2024. The company sent SMSs to its

customers informing them about this on March 22, 2024.

Mutual funds need KYC

From April 1, investors who have not re-done their KYC

(know your customer) will be not allowed to do any MF

transactions. These would include SIPs (systematic

investment plan), SWPs (systematic withdrawal plan)

and redemptions. Emails were sent by registrar and

transfer agents (RTAs), CAMS (Computer Age

Management Services) and KFin Technologies

(KFintech) to mutual fund distributors (MFD) that MF

investors should re-do their KYC (know your customer)

by March 31. The officially valid documents as

mentioned in these emails include Aadhaar card,

passport, voter ID card, among others. KYC done based

on proofs such as bank statements and utility bills will no

longer hold valid after this deadline.

By implementing these changes, we can achieve better

governance of the country's financial and economic

landscape. Investor awareness of these changes will

empower them to make informed decisions about their

financial limitations and opportunities for future

spending and investments.