The dawn of the new year in 2024 brought with it a sense

of hope and anticipation for investors, building upon the

excitement that characterized the end of December

2023. The global landscape, rife with uncertainties, and

the active economic measures taken by the current

government set the stage for a dynamic start to the year.

As economic numbers and corporate earnings painted a

promising picture, January 2024 saw markets reaching

all-time highs, only to experience a subsequent decline

by the end of the month. This rollercoaster ride was

marked by significant events that influenced both

domestic and international investors. The month kicked

off with a surge in market enthusiasm as economic

indicators and corporate earnings created an optimistic

atmosphere. However, this upward trajectory took a turn

towards the end of January, influenced by jittery investor

sentiment triggered by the corporate results of Q3 and

the interim budget expectations. Major sectors,

particularly banking and IT, witnessed profit bookings

and leading to a marginal 0.03% decrease in Nifty at the

end of the month, driven by global cues.

A pivotal moment occurred on January 17, 2024, when

the markets experienced a significant crash. The Sensex

plummeted by 1600 points, and Nifty saw a decline of

over 400 points, with Nifty Bank taking the hardest hit,

dropping by 2060 points in a single day. The following

day witnessed a further slide, with Sensex falling below

71000 and Nifty dropping below the 22000 mark. On

January 18, the Sensex recorded a decrease of 757.36

points, settling at 70,751.77, and Nifty faced a decline of

279.80 points, reaching 21,292.15. This volatile start to

2024 saw the market touch all-time highs on January 16,

only to touch all-time lows in the next two days. The

primary trigger for this crash was the stagnant Q3 results

of HDFC Bank. However, the market rebounded, with the

IT sector's corporate numbers reinvigorating investor

confidence, leading to the Sensex touching over 71500

points by January 19. The losses were offset by strong

December 2023 quarter earnings, coupled with hopes of

a rate cut in March.

Foreign Portfolio Investors (FPIs) played a crucial role in

shaping the economic landscape in January 2024. They

turned net sellers during the month, divesting Indian

equities worth ₹25,744 crore. This trend was spurred by a

rise in US bond yields, which triggered a sell-off in the

cash market. The debt market rally, initiated by the Fed

pivot, resulted in the 10-year bond yield falling from 5% to

around 3.8%. The recent increase to 4.18% aspected that

a Fed rate cut might only occur in the second half of

2024. This potential rate cut could attract FPIs back into

cash markets, especially to the Indian economy which

appears more promising than other developing

economies.

In the Indian debt market, FPI inflows continued since

April 2023, showcasing significant variations in equity

and debt segments in January. Equity witnessed net

selling of ₹25,734 crore, while debt saw net buying of

₹19,836 crores (NSDL). Factors contributing to these

trends include the rising US bond yields, high PE ratios in

the equity market (around 21 on estimated earnings),

and inclusion of Indian bond in the JP Morgan Bond

index, which attracted FPIs anticipating future profits.

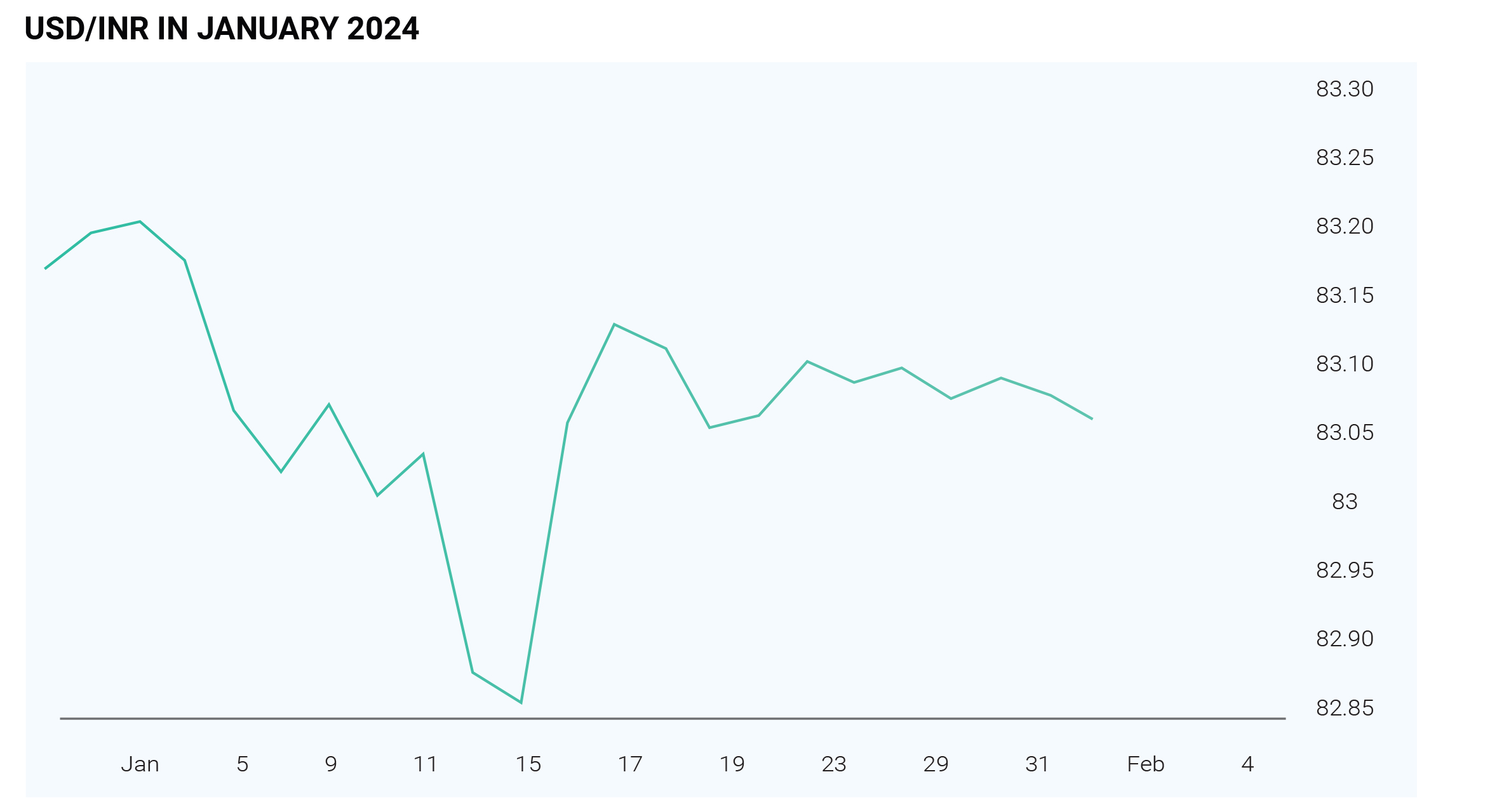

Remarkably, the Indian Rupee emerged as the

top-performing Asian Currency in the forex market for

January 2024. Despite depreciation observed in other

Asian currencies, the Indian Rupee appreciated by 1% to

2%. The currency held stronger against the US Dollar,

appreciating nearly 0.1% in the dollar index. However, the

growth of the Indian Rupee is hindered by a stronger US

Dollar, preventing it from breaking below the 83

threshold. The Finance Ministry's review emphasized the

resilience of the Indian economy amid global challenges,

attributing it to robust domestic demand, investment-led

strategies, and macroeconomic stability.

The Indian government's ambitious projections envision

the country becoming the world's third-largest economy,

with a projected Gross Domestic Product (GDP) of $5

trillion over the next three years. Despite this positive

outlook, external risks such as sticky inflation, sluggish

global growth, and fiscal pressures in the global

economy, coupled with ongoing tension around the Red

Sea, pose potential threats. The Fiscal Budget 2024–25

aims to lower the fiscal deficit to 5.30% of GDP in

2024–25 from 5.90% in the current fiscal year. Welfare

spending is set to increase, with the government

targeting a 4.5% budget deficit as a percentage of GDP

by fiscal year 2025–26. As of January 29, India’s GDP

was estimated at $3.7 trillion, reflecting significant

growth from its position as the tenth-largest economy a

decade ago, with a GDP of $1.9 trillion.

Gold prices experienced volatility throughout January

2024, closing at lower levels. The Federal Reserve's rate

decisions played a pivotal role in determining the

movement of the Rupee against the dollar. In the third

week, gold prices fell as uncertainty surrounded the

Federal Reserve's interest rate cut cycle, closing at a

round 2036 USD/t.oz on January 31, 2024.

On the energy front, crude oil prices witnessed an

upswing in January due to global uncertainties. China's

economic slowdown, the collapse of China’s property

sector, ongoing conflicts in the Middle East, deteriorating

US-Iran conflict conditions, and OPEC's future decisions

on production plans all contributed to the volatility in

Brent crude prices.

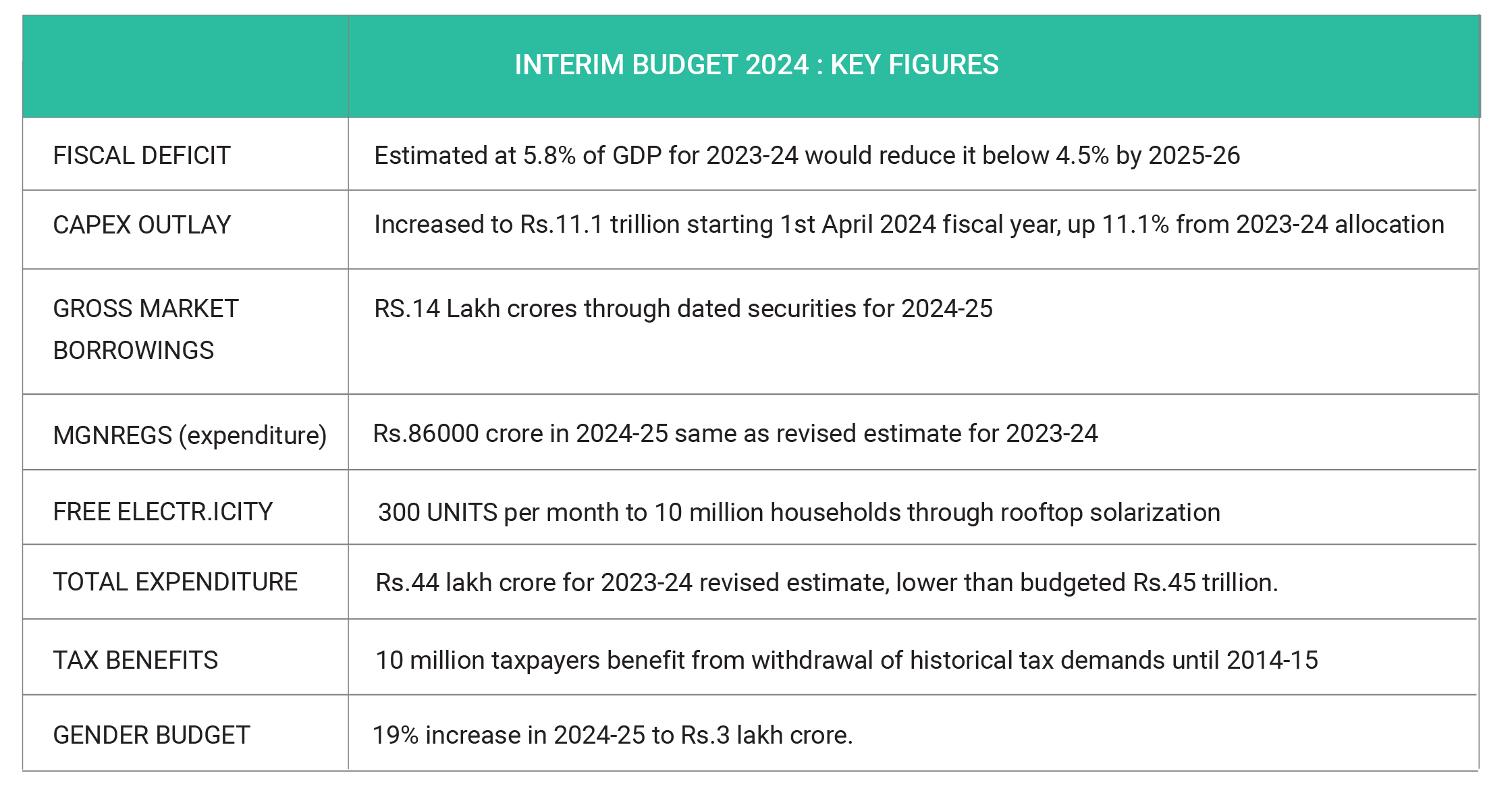

The unveiling of the Interim Budget was met with positive

market reactions. The budget's focus on fiscal

consolidation, along with increased attention on sectors

such as infrastructure, railways, defense, green energy,

tourism, agriculture, and electric vehicles (EVs), garnered

favourable responses. The Fiscal Deficit target for FY25

was set at 5.1% of GDP, surpassing expectations, while

the FY24 target was revised down to 5.8%. Additionally,

the capex target of FY25 was increased by 11.1% to

₹11.1 lakh crore. Private capex cycles and rural spending

were emphasized in the budget. However, global factors

such as corporate earnings, monetary policy outlooks

from various central banks worldwide, election years for

over half of the world, and ongoing war conflicts

affecting commodities, are anticipated to impact

markets in the coming months.

Following the Interim Budget, bond yields moved

southward, prompting a surge in FPIs towards the debt

market. However, the equity markets are expected to

remain unstable in the next month due to prevailing

global uncertainties. The government's emphasis on

fiscal consolidation, coupled with increased focus on key

sectors, has resonated positively with market

participants, fostering a sense of confidence in the

economic trajectory.

The economic landscape of January 2024 showcased

the intricate interplay of domestic and global factors.

The rollercoaster ride experienced by the markets, from

record highs to significant lows, reflected the volatility

and uncertainty prevailing in the global economic

scenario. As investors navigate through these

challenges, the resilience of the Indian economy,

strategic policy measures, and global economic

dynamics will continue to shape the trajectory of the

financial landscape in the coming months.

On 31st January, the Reserve Bank of India (RBI) has

taken decisive action against Paytm Payments Bank,

barring the fintech giant from offering a range of banking

services. This includes accepting deposits and

processing payments, marking a significant setback for

one of India's prominent financial entities.

The roots of Paytm Payments Bank's woes can be traced

back two years when the RBI first raised concerns about

the interactions between Paytm's payments app and its

banking arm. Despite a lengthy timeline, the issues

remained unaddressed, leading to the recent regulatory

intervention.

June 18 : Regulatory Hurdles

Paytm Payments Bank faced its first regulatory obstacle

in June 2018, just a year after securing a banking license.

The RBI temporarily halted the opening of new accounts

due to violations of licensing conditions, including

breaches of day-end balances and non-compliance with

KYC guidelines. Although the ban was lifted by

December 2018, it set the stage for a series of

challenges.

October 2021: False Information and Monetary

Penalties

In October 2021, the RBI discovered that Paytm

Payments Bank had submitted false information,

resulting in a fine of ₹1 crore. This incident highlighted

the importance of accurate reporting in the financial

sector, emphasizing the need for transparency and

adherence to regulatory standards.

March 2022: Supervisory Restrictions

March 2022 saw the imposition of supervisory

restrictions by the RBI, citing lapses in technology,

cybersecurity, and KYC anti-money laundering

compliance. The directive included the immediate

cessation of onboarding new customers and the

appointment of an external IT audit firm to conduct a

comprehensive system audit.

October 2023: Continued Non-Compliance

March 2022 saw the imposition of supervisory

restrictions by the RBI, citing lapses in technology,

cybersecurity, and KYC anti-money laundering

compliance. The directive included the immediate

cessation of onboarding new customers and the

appointment of an external IT audit firm to conduct a

comprehensive system audit.

October 2023: Continued Non-Compliance

Despite these regulatory actions, Paytm Payments Bank

allegedly failed to take adequate corrective measures. By

October 2023, the RBI imposed a hefty monetary penalty

of ₹5.39 crore for persistent non-compliance with KYC

norms, citing various failures, including lapses in

video-based customer identification processes.

Current Status and Impact on Users:

As of January 2024, the RBI has directed Paytm

Payments Bank to halt new credit and deposit operations

after February 29 due to ongoing non-compliance and

supervisory concerns. Paytm users can continue to

accept or receive funds until this date, after which only

withdrawals or fund transfers from the wallet or bank

account will be allowed until the balance is exhausted.

For Paytm users, the implications include a restriction on

fresh deposits, top-ups, and certain banking services

from March 1, affecting fund transfers through AEPS,

IMPS, and UPI. Merchants using QR codes linked to

Paytm will need to migrate to new bank partners.

Business Impact and Future Outlook:

The repercussions for Paytm extend beyond immediate

financial penalties. The company's shares plummeted

following the RBI's actions, with a potential worst-case

impact of ₹3-5 billion on its annual EBITDA. The primary

focus for Paytm now lies in restoring regulatory

compliance, mitigating reputational concerns, and

ensuring a smoother path to resolution.

The Paytm Payments Bank saga serves as a cautionary

tale about the importance of regulatory adherence in the

financial sector.

Copyright © 2021 Fintso